|

Customer Support

219-756-3502

Toll Free - 800-987-1920 |

X_Trader® 7

The front-end screen of choice for professional derivatives traders all over the world. Choose X_TRADER or X_TRADER Pro.

Simply put, the X_TRADER platform sets the standard for trading screen performance. Loaded with advanced trading strategy support, supremely reliable and reflex-fast, the X_TRADER platform enables you to trade via the web or any remote connection. High-performance connections to the major third-party exchanges enable you to trade the world's leading electronic futures exchanges in real-time.

X_Trader® ProX_TRADER Pro can really make a difference in how you trade:

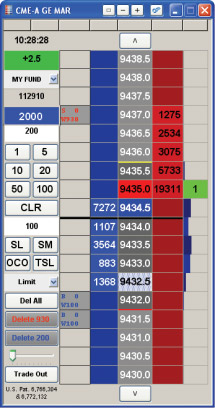

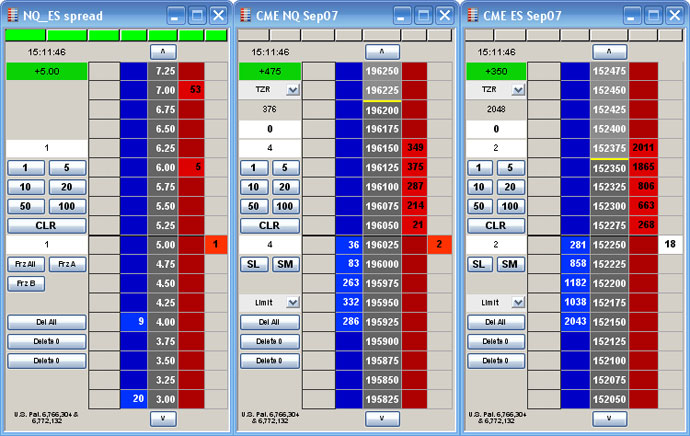

AutoSpreaderAutospreader is the most powerful tool for spread traders. Autospreader is one of several automated trading applications build into X_TRADER Pro. It helps create, manage and execute inter-product and cross-exchange spread trading strategies. Autospreader's multi-legged functionality lets you easily generate multiple spreads with up to ten legs and simultaneously quote up to three legs. This fast, flexible automated order management tool allows you to quickly define and manage spreads. Autospreader works the legs in the outright markets to match the desired spread price. This dynamic tool incorporates a range of capabilities to provide you with maximum flexibility:

X_Trader APIMaximize Your Edge with Custom ApplicationsYou can extend the power of X_TRADER Pro through the X_TRADER API. By tapping into the X_TRADER API, you can develop custom add-on applications that enhance your electronic trading strategy. Applications developed using the X_TRADER API can receive real-time prices and updates, submit orders, receive order and fill update information, manipulate orders that exist in the X_TRADER order book and more. The X_TRADER API allows you to develop applications that:

SpeedTT's low-latency exchange gateways are second-to-none for performance and reliability. The X_TRADER API allows users to develop and deploy custom applications that leverage the advantages of the TT platform. Sophisticated applications involving single or multiple exchanges and contracts can be developed quickly and effectively using the X_TRADER API.Join the TT Developer Program TodayWhen you join the TT Developer Program, you will get access to documentation, educational materials, X_TRADER API sample code and the latest development and test tools.X_Trader PricingX_Trader is $50 per month plus 30 cents per side fill ($1000 cap)X_Trader is $400 per month plus 30 cents per side fill ($1800 cap) TT TrainerWhether developing new trading models or assessing the skills of a new trader, running TT Trainer can now get you as close to live trading as possible without risking capital.All Real - Except for P<T Trainer is not a canned simulation. The exchanges are real. The products are real. Price feeds and market depth are real - and live within milliseconds. You can even run your preferred analytical tools and respond as if real money was on the line.

TT Trainer PricingTT Standard is $50 per month plus 30 cents per side fill ($1000 cap)TT Pro is $400 per month plus 30 cents per side fill ($1800 cap) This third-party trading platform demo is designed as an introduction to the platform and its functionality. It is not intended to mimic trading results in a live trading environment. In an actual live trading environment, commissions and fees would be applied at the close of every business day, and an account statement would be generated. Daily statements and the associated fees are not applied within the demo environment and as such, those fees, which may have a material impact on your account, are not reflected in final profit and loss calculations within this demo. Other factors such as latency fill price and execution times may also differ from live trading results. It is not intended for this demo to be an accurate representation of actual profits or losses that may occur in a live trading environment. These 3rd party platforms generally supply the user with real-time market data, however that can change at any time and without notice. This data should not be considered an adequate approximation of the trading results or experience that may occur in a live-trading environment. |

Trading PlatformsAll Trading Platforms Firetip Trading Platform IB Web Trader Ninja Trader Sierra Chart TT X Trader TT X Trader ProOur ServicesAccount Types Free Papertrading |