|

Customer Support

219-756-3502

Toll Free - 800-987-1920 |

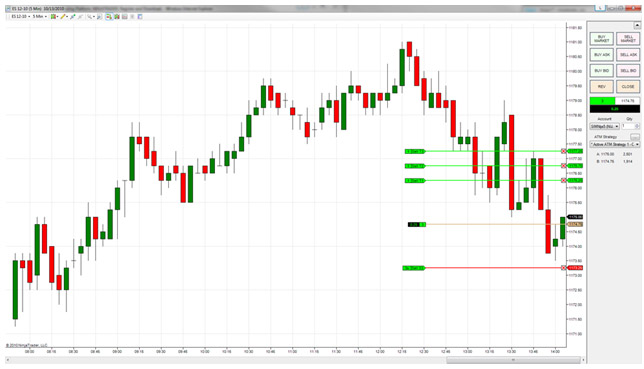

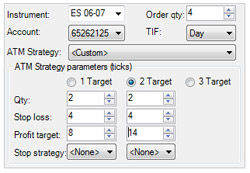

NinjaTrader®Product DescriptionAs an active discretionary trader or system trader, the trading tools you select will have a dramatic impact on your success. You can significantly enhance your trading efficiency through NinjaTrader's® powerful array of analytic tools, innovative trade management features and industry proven order execution capabilities. NinjaTrader provides a complete end-to-end platform for strategy creation, testing and automation. Try a free simulated trading experience to learn more about the many powerful NinjaTrader features! NinjaTrader offers multiple order interface options which gives you the power and flexibility to confidently manage your futures orders and positions no matter what style of trader you are. Feel free to signup for our free real-time NinjaTrader demo/simulator to test drive it yourself.

This third-party trading platform demo is designed as an introduction to the platform and its functionality. It is not intended to mimic trading results in a live trading environment. In an actual live trading environment, commissions and fees would be applied at the close of every business day, and an account statement would be generated. Daily statements and the associated fees are not applied within the demo environment and as such, those fees, which may have a material impact on your account, are not reflected in final profit and loss calculations within this demo. Other factors such as latency fill price and execution times may also differ from live trading results. It is not intended for this demo to be an accurate representation of actual profits or losses that may occur in a live trading environment. These 3rd party platforms generally supply the user with real-time market data, however that can change at any time and without notice. This data should not be considered an adequate approximation of the trading results or experience that may occur in a live-trading environment. |

Trading PlatformsAll Trading Platforms Firetip Trading Platform IB Web Trader Ninja Trader Sierra Chart TT X Trader TT X Trader ProOur ServicesAccount Types Free Papertrading |