Real-time Quotes and Depth of Market

BEST Direct gives customers access to real-time data for all e-cbot products,

including mini-Dow and Treasury futures contracts. This enables you to view real-time

quotes for Treasury futures and the leading stock index futures contracts on

the same screen.

This BEST Direct screen shot

shows real-time quotes with current bid and

ask price and quantity for the E-mini Nasdaq,

mini-Dow, Treasury bond and 10-year Treasury

Note, and E-mini S&P 500.

BEST

Direct also shows depth of market going five prices deep

for all e-cbot contracts.

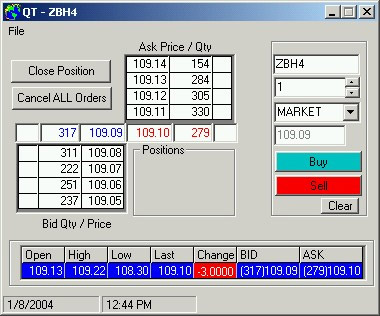

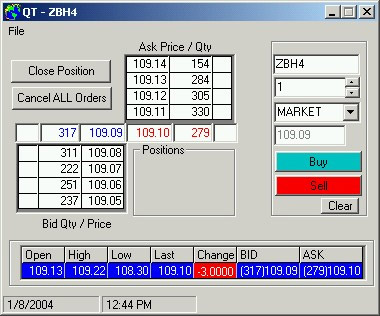

BEST Direct quick trade

window showing depth of market information

for the March 30-year Treasury Bond futures

contract.

Trading online involves risks. Please review your

Customer Agreement for specifics.

Download BEST Update

If you are currently using BEST Direct and would like to receive real-time streaming

quotes for E-CBOT contracts, you first must download an update file. Here's

how to download and install that file:

- Go to the BEST Direct Downloads page.

- Click on 7.5 Full Version (11.4 MB)

- Select the "save" option and save

the program in a location that will be easy to locate,

such as your desktop or a BEST Direct program folder.

- Then click "open" on the pop-up window, and follow

the instructions on your screen to install the software.

E-CBOT Trading Hours

CBOT markets open earlier on e-cbot than they did on a/c/e. Here are current

trading hours for all e-cbot products:

| Stock Index |

• |

Mini-sized Dow ($5) Futures: 7:15

p.m. - 4:00 p.m. |

• |

DJIA ($10) Futures: 7:15 p.m. - 7:00 a.m. |

• |

DJIA Options: 7:17 p.m. - 7:00

a.m. |

| Interest Rates and Metals |

• |

T-bond Futures: 7:00 p.m. - 4:00

p.m. |

• |

T-bond Options: 7:02 p.m. - 4:00 p.m. |

• |

Mini-sized T-bond Futures: 7:00

p.m. - 4:00 p.m. |

• |

2-year Treasury Note Futures:

7:01 p.m. - 4:00 p.m. |

• |

5- and 10-year Treasury Note Futures:

7:00 p.m. - 4:00 p.m. |

• |

2-, 5- and 10-year Treasury Note

Options: 7:02 p.m. - 4:00 p.m. |

• |

Mini-sized 10 year T-note Futures:

7:00 p.m. - 4:00 p.m. |

• |

5- and 10-year Agency Note Futures:

7:04 p.m. - 4:00 p.m. |

• |

5- and 10-year Agency Note Options:

7:06 p.m. - 4:00 p.m. |

• |

Mini-sized Eurodollar Futures: 7:00 p.m. - 4:00

p.m. |

• |

5-year and 10-year Interest Rate

Swap Futures: 7:03 p.m. - 4:00 p.m. |

• |

5-year and 10-year Interest Rate Swap Options 7:05

p.m. - 4:00 p.m. |

• |

10-year Muni Note Futures: 7:04

p.m. - 4:00 p.m. |

• |

Fed Funds Futures: 7:01 p.m. - 4:00 p.m. |

• |

Fed Funds Options: 7:02 p.m. -

4:00 p.m. |

• |

Mini-sized Gold and Silver Futures: 7:16 p.m. -

4:00 p.m. |

| Ag Products and DJ/AIG Index |

• |

Corn Futures: 7:30 p.m. - 6:00

a.m. |

• |

Corn Options: 7:32 p.m. - 6:00 a.m. |

• |

Soybean Complex Futures: 7:31

p.m. - 6:00 a.m. |

• |

Soybean Complex Options: 7:33

p.m. - 6:00 a.m. |

• |

Wheat Futures: 7:32 p.m. - 6:00

a.m. |

• |

Wheat Options: 7:34 p.m. - 6:00

a.m. |

• |

Oats and Rough Rice Futures: 7:33

p.m. - 6:00 a.m. |

• |

Oats and Rough Rice Options: 7:35

p.m. - 6:00 a.m. |

• |

DJ-AIG Commodity Index: 8:15 a.m.

- 1:30 p.m. |

To test the real thing, tcry our FREE

for 30 days.

Past performance is not indicative of future results. Trading futures and options is not suitable for everyone.

There is a substantial risk of loss in trading commodity futures, options and off exchange forex.