|

|

Corn Futures

Corn is by far the largest component of global coarse-grain trade, accounting for about three-quarters of total volume in recent years. (Coarse grains make up a common trade category that includes corn, sorghum, barley, oats, and rye.) Most of the corn that is traded is used for feed; smaller amounts are traded for industrial and food uses. Processed-corn products and byproducts—including corn meal, flour, sweeteners, and corn gluten feed—are also traded, but are not included in this discussion of corn trade.

U.S. Corn Trade

Exports are significant for the U.S. corn industry, with exports averaging 21 percent of total use during the 1990s. During the 1990s, corn grain (excluding popcorn or sweet corn) accounted for an average of over 11 percent of all U.S. agricultural exports by value, indicating the importance of corn exports to the U.S. economy.

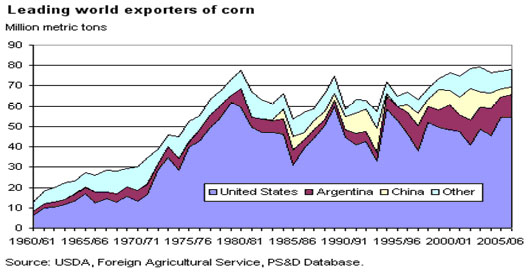

The United States is the world's dominant corn exporter, averaging 70 percent of world corn exports during the 1990s. U.S. corn exports soared in the 1970s from 13 million metric tons to a record 62 million in 1979/80 (the international trade year is October-September). The growth was due to strong demand in the former Soviet Union as well as Japan, Western and Eastern Europe, and developing countries. Over the next few years, corn exports dropped, bottoming out at 31 million metric tons in 1985/86, due to poor global economic growth, expansion of the European Union (EU), and U.S. government support for domestic corn prices.

In the second half of the 1980s, U.S. exports rebounded, reaching 60 million metric tons in 1989/90 because of large domestic supplies and more competitive prices as the government reduced commodity loan rates. Exports in the early 1990s declined again because of external factors, notably the breakup of the former Soviet Union and rising Chinese corn exports. During the 1990s and into the current decade, U.S. corn exports have varied because of China's inconsistent export policies, production developments in Argentina, and changes in importers' demand.

World Corn Trade

While the United States dominates world corn trade, exports only account for a relatively small portion of demand for U.S. corn—about 20 percent. This means that corn prices are largely determined by supply-and-demand relationships in the U.S. market, and the rest of the world must adjust to prevailing U.S. prices. This makes world corn trade and prices very dependent on weather in the U.S. Corn Belt. However, Argentina , the second-largest corn exporter in most years, is in the Southern Hemisphere. Farmers there plant their corn after the size of the U.S. crop is known, providing a quick, market-oriented supply response to short U.S. crops.

China has been a significant source of uncertainty in world corn trade, swinging from being the second-largest exporter in some years to occasionally importing significant quantities. China's corn exports are largely a function of government export subsidies and tax rebates, because corn prices in China are mostly higher than those in the world market. Large corn stocks are expensive for the government to maintain, and Chinese corn export policy has fluctuated with little relationship to the country's production, making China's corn trade difficult to predict.

Several countries—including Brazil, Ukraine, Romania, and South Africa—have had significant corn exports when crops were large or international prices attractive. As countries like Hungary enter the European Union, their corn shipments that previously went to the rest of the world have been diverted to the EU.

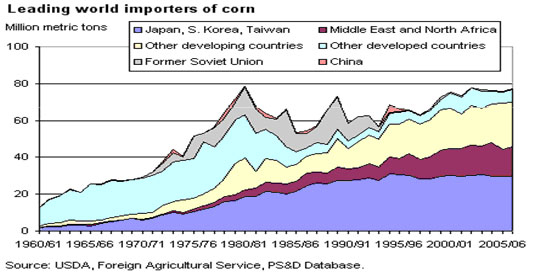

World corn trade peaked in 1980/81 with large imports by the Soviet Union and Europe. Since then corn imports by EU countries have declined steadily as the Common Agricultural Policy limited grain imports and membership expanded. At the end of the 1980s, the Soviet Union's political and economic reforms led to a liquidation of livestock herds and a drop in corn imports in the former Soviet Union and Eastern Europe. During the same time period, Japan, South Korea, and Taiwan continued to increase corn imports to support increasing meat production and consumption.

Developing countries worldwide have continued to increase corn imports at a fairly steady pace since 1980. This growth in developing-country imports has propelled corn trade above 70 million metric tons each year since 1999/2000. Projections for U.S. corn exports are in USDA's Agricultural Baseline Projections, which provides 10-year projections for the U.S. and world agricultural sector for selected commodities.

Japan is the largest corn importer by far. While producing almost no coarse grains, Japan is a very large meat producer, so the country is a steady buyer of corn, with attention to quality. In recent years, Japanese imports of corn for livestock feed have stagnated, while imports for industrial use and starch manufacturing have increased. South Korea is the second-largest importer of corn in the world. South Korea is a price-conscious buyer, willing to switch to feed wheat or other coarse grains, and ready to buy corn from the cheapest source. Mexico is a growing importer. While a large corn producer, Mexico processes much of its production of white corn into human food products, but has turned to imported yellow corn and sorghum for livestock feed to support increased meat production.

Foreign demand is not only dependent on importing countries' demand for feed ingredients but also those countries' internal policy changes that adjust prices and/or the availability of competing products. Coarse grains can often substitute for each other in feed use. Corn competes with other feed grains, as well as with wheat and nongrain feedstuffs such as cassava. Oilseed meal and other protein sources serve mostly as complements to grains, but can also be substitutes, especially those protein meals with low-protein content. Flexibility in many markets, however, is limited by the types of animals fed, the desire to maintain stable rations, local preferences, and import tariffs and laws. Importers not only substitute among grains, but may switch suppliers of the same grain based on price, quality, availability, credit, or other trade services.

Corn Futures Information

Corn Futures Contract Size

5,000 bushels

Deliverable Grades

No. 2 Yellow at par, No. 1 yellow at 1 1/2 cents per bushel over contract price, No. 3 yellow at 1 1/2 cents per bushel under contract price

Tick Size

1/4 cent/bushel ($12.50/contract)

Price Quote

Cents/bushel

Corn Futures Contract Months Dec, Mar, May, Jul, Sep

Corn Futures Last Trading Day The business day prior to the 15th calendar day of the contract month..

Corn Futures Last Delivery Day Second business day following the last trading day of the delivery month.

Corn Futures Trading Hours

Open Auction: 9:30 a.m. - 1:15 p.m. Central Time, Mon-Fri.

Electronic: 6:30 p.m. - 6:00 a.m. and 9:30 a.m. - 1:15 p.m. Central Time, Sun.-Fri.

Trading in expiring contracts closes at noon on the last trading day.

Corn Futures Ticker Symbols Open Auction: C Electronic: ZC

Corn Futures Daily Price Limit Twenty cent ($0.20) per bushel ($1,000/contract) above or below the previous day's settlement price. No limit in the spot month (limits are lifted beginning on First Position Day

|